If you ask 10 people how much it costs to start a PG business, you’ll get answers ranging from ₹3 lakhs to ₹1 crore.

Both are technically correct – and both are dangerously misleading.

In 2026, the real question is not “How much money do I need?” The real question is:

“How much money do I need so that my PG does not collapse in the first 12 months?”

This article breaks that down from a business survival lens, not a YouTube-reel lens.

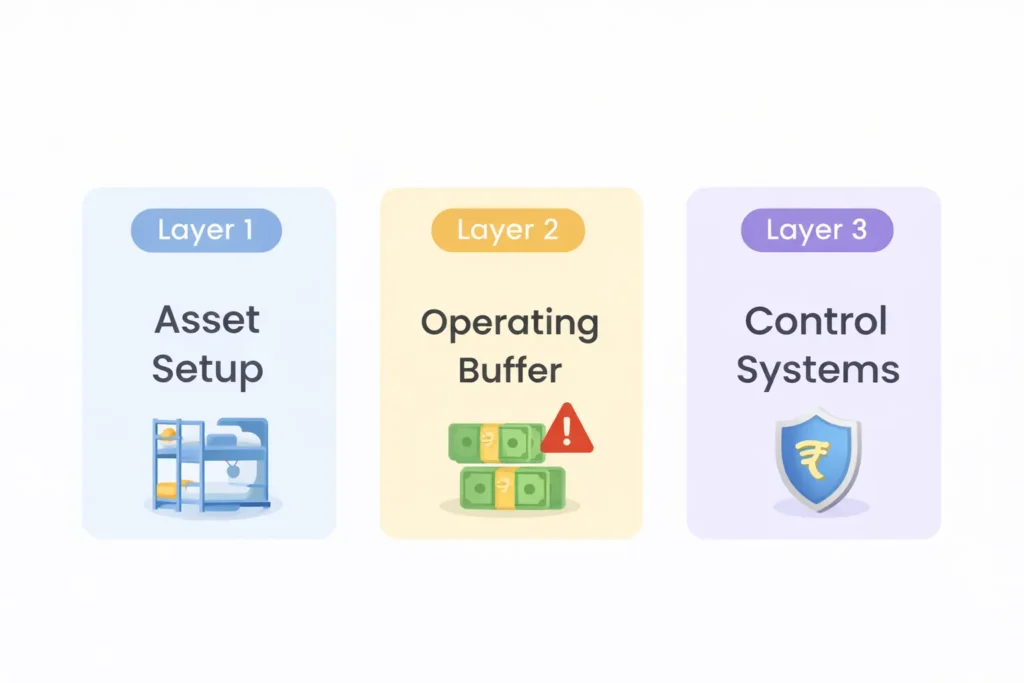

The 3 Layers of PG Investment (Most Blogs Miss This)

Most cost guides only talk about setup cost. In reality, PG investment has three distinct layers:

Layer 1: Asset Setup (Visible Cost)

Beds, cupboards, painting, deposit – what everyone talks about.

Layer 2: Operating Buffer (Ignored Cost ❌)

Cash needed to survive:

- Vacancies

- Late rent

- Repairs

- Staff inefficiency

Layer 3: Control Systems (Silent Profit Maker)

How you prevent leakage, not just earn rent.

👉 Most PGs fail at Layer 2 and Layer 3, not Layer 1.

Let’s go layer by layer.

Layer 1: Setup Cost (Reality Check for 2026)

A. Property Economics (Rented vs Owned)

Rented PG (Most First-Time Owners)

| Item | Typical Range |

| Monthly rent | ₹1.5L – ₹2.5L |

| Security deposit | ₹1.5L – ₹6L |

| Lock-in period | 2-5 years |

Hidden insight: Owners fixate on low rent, but ignore vacancy velocity. A slightly costlier location near colleges / IT hubs often fills 2–3x faster, saving months of losses.

B. Renovation: Where Capital Gets Burnt

2026 truth: Tenants don’t pay more for marble floors. They pay for experience.

| Expense Head | Smart Spend |

| Paint & repairs | ₹1–2L |

| Electrical & plumbing | ₹80k–₹1.5L |

| Bathrooms | ₹1–3L |

| Safety (CCTV, locks) | ₹40k–₹1L |

Owner mistake: Overspending on interiors → underfunding operations.

C. Furniture: Think “Per Bed ROI”

Average per-bed cost in 2026:

| Item | Cost |

| Bed + mattress | ₹5k–₹10k |

| Cupboard | ₹6k–₹9k |

| Table/chair | ₹2k–₹5k |

| Fan & lighting | ₹2k–₹3k |

➡️ ₹15k–₹32k per bed

Insight: Every ₹5,000 extra per bed needs ₹300–₹400 extra monthly rent just to break even.

Layer 2: Operating Buffer (Where PGs Actually Die)

This is the most under-calculated cost.

You MUST Assume These Will Happen:

- 15–25% beds vacant initially

- 10–20% tenants delay rent

- Staff forgets / hides collections

- Electricity, water, food overshoots estimates

Minimum Operating Buffer (Rule of Thumb)

| PG Size | Required Buffer |

| 10–15 beds | ₹1.5–2L |

| 20–30 beds | ₹3–5L |

| 50+ beds | ₹8–12L |

❌ Owners who invest every rupee into setup usually panic within 90 days.

Layer 3: Control Systems (This Decides Profit vs Stress)

Here’s a brutal truth:

A PG without systems is not a business – it’s a gambling table.

Where Money Leaks in PGs

- Cash collected but not recorded

- Partial payments forgotten

- Electricity & food dues unrecovered

- No clarity on monthly profit

- Owner realizes losses after 6 months

This is exactly why modern PG owners use RentOk.

Why RentOk Is Not “Software Cost” – It’s Capital Protection

When you invest ₹20–50 lakhs into a PG, managing it on Excel + WhatsApp is like running a factory without accounting.

What RentOk Controls (Practically)

- Automated rent & dues tracking (no memory dependence)

- UPI-based collections (less cash leakage)

- Tenant-level ledger (no disputes)

- Expense vs collection dashboard (real profit visibility)

- Defaulter & overdue alerts (faster action)

📉 Even 5% monthly leakage on a ₹5L rent roll = ₹25,000/month lost.

📈 RentOk typically saves ₹20k–₹50k/month for mid-sized PGs.

That’s not convenience. That’s ROI.

Realistic Investment Summary (2026)

Example: 25-Bed PG in Tier-1 / Tier-2 City

| Category | Amount |

| Deposit + rent advance | ₹4–5L |

| Renovation | ₹2–5L |

| Furniture & appliances | ₹4–5L |

| Legal & setup | ₹20k–₹1L |

| Operating buffer | ₹4–5L |

| Total | ₹12–27L |

➡️ Break-even: 14–20 months (well-managed)

➡️ Without systems: unpredictable

Final Insight: PG Is No Longer a “Side Business” in 2026

The PG business has matured.

Tenants expect:

- Digital payments

- Clear dues

- Transparency

Owners need:

- Predictable cash flow

- Zero leakage

- One dashboard view

RentOk is built exactly for this new reality.

If you’re committing serious money, you need serious control.