Renting vs. Buying a Home: Which Is the Right Choice for You?

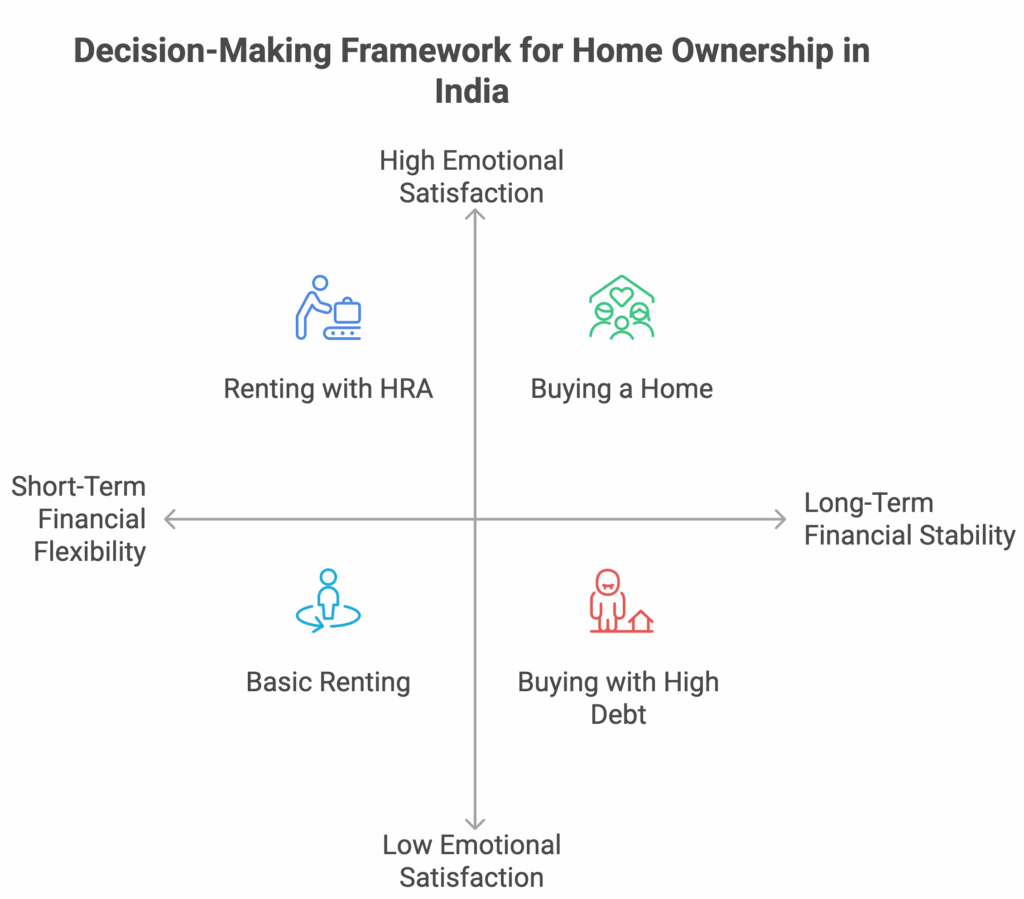

For most Indians, owning a house is a lifelong dream. It represents stability, pride, and success. But in today’s changing world, many people are rethinking which its better for them Renting vs Buying a home .

The answer isn’t the same for everyone. What’s right for one person may not suit another because it depends on your income, lifestyle, job stability, and future goals.

In this blog, we’ll break down the buying or renting a house which is better in India debate, compare the pros and cons of both, look at real financial examples, and help you decide which option is right for you.

What’s the Main Difference Between Renting and Buying a House?

When you rent a house, you pay a monthly rent to the owner to live there. The house does not belong to you, you are only paying for the right to stay.

When you buy a house, you invest a large amount of money (either from savings or through a home loan) and become the legal owner of that property. You build equity over time, but you also take on long-term responsibilities and costs.

In short:

- Renting = Flexibility and less financial pressure, but no ownership.

- Buying = Long-term stability and investment, but higher cost and commitment.

Buying vs. Renting a House in India: Key Factors to Compare

When deciding between renting and buying a home in India, you should consider several important factors. Let’s look at them one by one.

1. Initial Cost and Down Payment

- Buying:

Buying a house in India requires a big initial investment. Most banks ask for at least 20% of the property price as down payment, plus registration fees, stamp duty, and other charges.

For example, if a flat costs ₹80 lakh, you may need at least ₹15–₹18 lakh upfront. - Renting:

Renting a house needs only a security deposit (usually 2–6 months’ rent) and monthly rent.

So, renting is more affordable in the short term.

Verdict:

If you don’t have big savings, renting is a more practical option.

2. Monthly Expenses and Cash Flow

- Buying:

When you take a home loan, your EMI becomes your main monthly expense. Depending on the loan amount, it can easily be ₹40,000–₹70,000 or more per month.

You also need to pay for property tax, maintenance, and insurance. - Renting:

Monthly rent is often lower than an EMI for the same type of property.

For example, if a flat costs ₹80 lakh, the EMI may be around ₹60,000/month, while renting the same flat might cost only ₹25,000–₹30,000/month.

Verdict:

If you want to keep your monthly budget flexible or save for other goals, renting gives you more breathing room.

3. Long-Term Financial Value

- Buying:

Property value generally increases over time. If you stay long-term, you build equity and can sell the property later for profit.

However, property appreciation depends on location, infrastructure, and market conditions. In some cities, prices remain stagnant for years. - Renting:

Rent payments don’t create ownership or wealth once you move out, you don’t get that money back.

Verdict:

If you plan to stay in the same city for 10+ years, buying makes more financial sense. If your job or lifestyle might change, renting is safer.

4. Flexibility and Freedom

- Buying:

Once you buy a home, you are tied to that location. Selling property takes time and involves legal processes. - Renting:

Renting offers complete flexibility. You can shift cities, upgrade to a bigger house, or downsize easily. This suits young professionals, people with transferable jobs, and those still exploring career options.

Verdict:

If flexibility is important, renting is better. If you’re ready to settle down, buying brings stability.

5. Maintenance and Repairs

- Buying:

When you own a house, all maintenance costs are yours for eg, repairs, painting, plumbing, and society charges. Over time, this can become expensive. - Renting:

Most major repairs are handled by the landlord. Tenants only pay for minor fixes.

Verdict:

Renting reduces the headache of unexpected repair costs.

6. Emotional Satisfaction

Many Indians see owning a home as an emotional achievement. It brings a sense of security, pride, and stability for the family.

However, emotional satisfaction shouldn’t come at the cost of financial stress. If buying a house leaves you with heavy debt or little savings, it might create pressure instead of peace.

Verdict:

Emotionally, buying feels rewarding. Financially, renting may give more peace of mind in the short run.

7. Tax Benefits

- Buying:

Homebuyers can get tax benefits under Section 80C (for principal repayment) and Section 24(b) (for interest on home loan).

This can reduce taxable income by up to ₹3–₹3.5 lakh a year. - Renting:

Tenants can also claim HRA (House Rent Allowance) exemption under Section 10(13A) if they live in a rented home and receive HRA from their employer.

Verdict:

Both options give tax benefits, but buying offers long-term savings if you stay for many years.

Buying a House vs. Renting an Apartment: Pros and Cons

Here’s a simple comparison table that summarises the major pros and cons of buying vs. renting a house in India.

| Aspect | Buying a House | Renting a House |

|---|---|---|

| Initial Cost | Very high (down payment, registration, taxes) | Low (security deposit + monthly rent) |

| Monthly Expense | High EMIs + maintenance | Lower rent, limited expenses |

| Flexibility | Fixed location | Easy to move |

| Ownership | You own the property | No ownership |

| Wealth Creation | Builds long-term asset | No asset created |

| Maintenance | Owner pays for all | Mostly landlord’s responsibility |

| Tax Benefits | 80C + 24(b) deductions | HRA deduction if salaried |

| Emotional Value | High satisfaction | Lower sense of belonging |

In short:

- Buying is better for long-term wealth and stability.

- Renting is better for flexibility and lower stress.

Is It Better Financially to Rent or Buy a House?

To understand this clearly, let’s take a simple example.

Suppose you are choosing between buying and renting a 2BHK apartment in Pune.

| Parameter | Buying | Renting |

|---|---|---|

| Property Cost | ₹80,00,000 | ₹0 |

| Down Payment | ₹16,00,000 | ₹1,00,000 (deposit) |

| Loan Amount | ₹64,00,000 | – |

| EMI (20 years @8%) | ₹53,000/month | ₹25,000/month |

| Annual Maintenance | ₹30,000 | ₹0 |

| Property Tax | ₹15,000/year | ₹0 |

If you invest the difference (₹28,000 per month saved by renting) in a mutual fund at 10% return, after 20 years you could have around ₹1.9 crore.

Meanwhile, your owned property worth ₹80 lakh might grow to about ₹1.6 crore (assuming 3% annual appreciation).

In this case, renting + investing the savings gives a better financial return.

However, if the property value grows faster (say 6–7%), buying may win.

So, use a buying vs renting a house calculator online to compare both scenarios for your city and budget. Websites like MagicBricks, 99acres, and BankBazaar offer free calculators.

What Do People Say Online About Renting(Reddit & Forums)?

If you check discussions on platforms like Reddit and real estate forums, you’ll see mixed opinions:

- Some users say buying a home early gives peace of mind, especially if you plan to stay long-term.

- Others believe renting and investing the difference brings better returns and flexibility.

- Many also warn that property taxes, maintenance, and resale difficulties are often underestimated by buyers.

The “right choice” depends on your personal goals not just financial logic.

When Should You Rent?

Renting makes more sense if:

- You are in your 20s or 30s and still exploring your career or city.

- You don’t have a stable job or enough savings for a down payment.

- You might move to another city soon.

- You want flexibility and lower monthly expenses.

- You prefer investing in other assets like mutual funds or business instead of property.

When Should You Buy?

Buying is a better choice if:

- You have stable income and long-term plans in one city.

- You can comfortably afford the EMI without sacrificing lifestyle.

- You plan to stay in the house for at least 10–15 years.

- You want to build equity and pass down the asset to your family.

- You value emotional satisfaction and long-term security over flexibility.

Renting vs. Buying a House: Pros and Cons (Summary)

What are the pros and cons of the following:

Renting Pros:

- Low upfront cost

- Freedom to move

- Less responsibility for repairs

- Easier budgeting

Renting Cons:

- No ownership

- Rent may increase every year

- No long-term wealth creation

Buying Pros:

- Ownership and pride

- Asset value grows over time

- Tax benefits

- Stability for family

Buying Cons:

- High upfront and monthly cost

- Limited flexibility

- Ongoing maintenance expenses

Final Thoughts

There’s no single right answer to the “renting vs. buying a home” question.It depends on your financial situation, career stability, lifestyle, and long-term goals.

If you value flexibility, low stress, and short-term savings: renting might be ideal.If you seek stability, ownership, and emotional satisfaction: buying is the way to go.

The smartest approach is to run the numbers, consider your life plans, and make a balanced decision. Remember, a home isn’t just a financial investment, it’s also an emotional one.

To get more in depth information of Rentals go to RentOk.

Frequently Asked Questions

1. Is it better financially to rent or buy a house in India?

It depends. If property prices in your city are very high and you plan to move often, renting is better financially. But if you’re settled in one place for 10+ years, buying helps you build wealth.

2. What’s the thumb rule for deciding between rent and buy?

A general rule is the Price-to-Rent ratio.

If a property’s price is more than 20 times the annual rent, renting is usually better.

For example, if annual rent is ₹3 lakh and property costs ₹80 lakh (26x), renting wins.

3. How do I calculate if buying is worth it?

Use a buying vs renting calculator online. Enter property cost, loan amount, EMI, rent, and expected returns on investments. It will show which option gives better long-term returns.

4. Are home loans worth it in India?

Yes, but only if EMIs are less than 30–35% of your income. Over-borrowing can hurt your financial health. Choose a comfortable loan tenure and interest rate.

5. Is buying always better in small towns?

In smaller cities where property prices are lower, buying often makes sense. The rent-to-price ratio is more balanced, and property appreciation can be strong if development is rising.

6. What if I already own a house in another city?

If your owned house is in a different city, it may still make sense to rent where you live now. Renting helps you stay flexible without selling your property.