5 Hidden Ways PG Owners Lose Money Every Month (And How to Fix Them)

Running a Paying Guest (PG) accommodation business is often assumed to be simple: fill beds, collect rent, and manage basic operations.

But in reality, many PG owners struggle with a silent problem – revenue leakage.

There is usually a wide gap between:

- Revenue (what you should earn), and

- Realized Profit (what actually remains in your bank account)

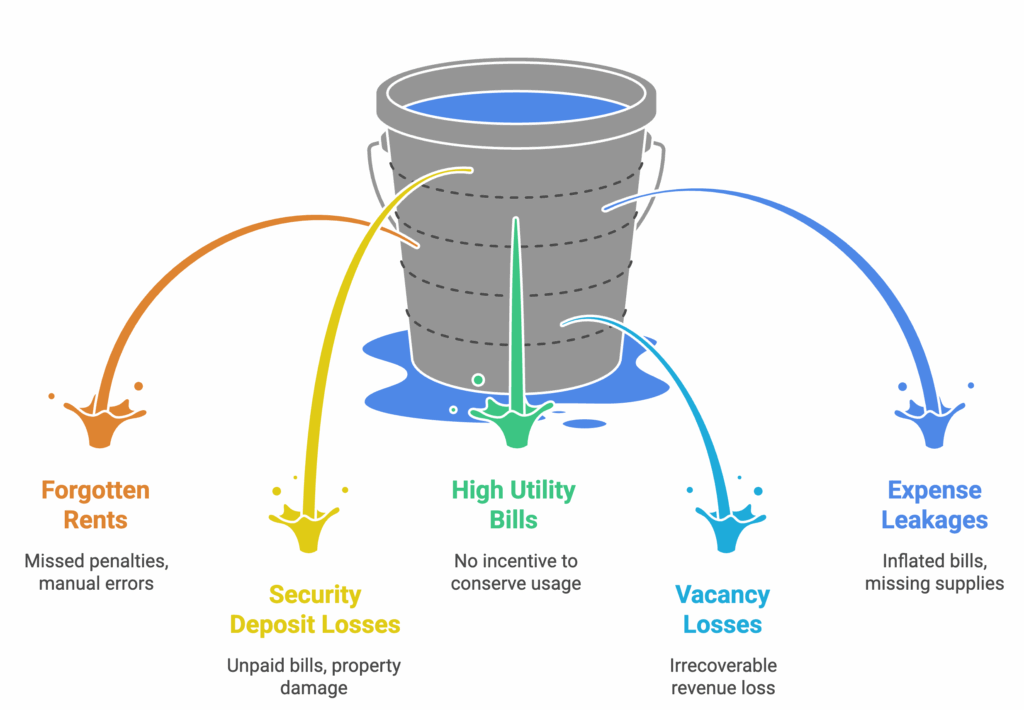

Most PG owners believe the solution is finding more tenants. In practice, the bigger issue is poor operational control. Think of your PG like a leaky bucket – adding more water won’t help unless you seal the holes.

Below are the five most common ways PG owners lose money every month, along with practical ways modern PG operators are fixing them.

1. Forgotten Rents, Missed Penalties & Manual Tracking Errors

Managing rent through registers, spreadsheets, or informal WhatsApp messages may work when you have a handful of tenants, but this system quickly collapses as occupancy grows. As the number of residents increases, PG owners often forget pending balances, hesitate to collect late fees due to awkward face-to-face conversations, or fail to follow up consistently. These small lapses create hidden revenue leakages that are rarely documented.

Even minor delays can result in significant losses over time. For example, if 10 tenants delay their rent by just five days and the applicable late fee is ₹500 per tenant, the loss amounts to ₹5,000 per month or ₹60,000 annually in a 50-bed PG. Because this money is never formally tracked, most owners don’t realize how much profit they are losing.

The Loss: Small amounts (₹500 late fees, ₹1,000 pending balances) add up. In a 50-bed PG, if 10 people pay 5 days late without a penalty, you lose ₹5,000/month or ₹60,000/year.

The RentOk Solution: RentOk removes the “human” element from debt collection. The system sends automated WhatsApp and SMS reminders with payment links. Because the system calculates the late fee automatically on the 6th of the month, the tenant pays it without you having to play the “bad guy.”

The Result: 100% collection of late fees and zero “forgotten” balances.

Professional PG operators address this issue by using digitized rent collection systems that automatically track dues, send reminders, and apply late fees uniformly. Platforms like RentOk automate WhatsApp and SMS reminders while generating structured monthly invoices. This removes human error and emotional discomfort from the collection process, resulting in predictable cash flow, zero forgotten dues, and consistent enforcement of payment policies.

2. Security Deposit Losses & “Ghost Resident” Problems

Without structured onboarding and exit documentation, PG owners frequently face problems related to security deposits and undocumented occupancy. Tenants may leave without settling utility bills, cause property damage without accountability, or occupy beds without formal records, leading to financial and operational confusion.

These issues translate into real costs such as broken appliances, damaged walls, repainting expenses, deep cleaning, and unrecovered electricity bills. During periods of frequent tenant turnover, these expenses silently erode profitability.

The Loss: Tenants moving out and leaving behind broken fans, stained walls, or unpaid electricity bills. If you don’t have proof of the room’s condition at check-in, you end up paying for these repairs out of your own pocket.

The RentOk Solution: RentOk’s Digital Onboarding requires a move-in checklist and photo evidence. When a tenant leaves, the “Full & Final” (F&F) settlement feature automatically pulls up their pending dues, damages, and utility bills, deducting them from the security deposit before it’s refunded.

The Result: You never pay for a tenant’s damage again.

Modern PG operators mitigate these risks by adopting digital onboarding and exit processes. This includes move-in checklists, photographic documentation of room conditions, and structured move-out settlements. With digital onboarding and Full & Final (F&F) settlement features, systems like RentOk ensure that any pending dues or damages are adjusted against the security deposit before refunds are issued. As a result, owners no longer have to pay out of pocket for tenant-caused damage.

3. High Electricity & Water Bills Due to Flat Pricing

Utilities represent one of the largest variable costs in PG operations. When electricity and water are charged at a flat rate, tenants have little incentive to control consumption. This often leads to excessive usage, especially with high-load appliances like air conditioners and geysers.

The financial impact can be substantial. A single air conditioner running unnecessarily can cost more than ₹2,000 per month. When multiplied across multiple rooms and floors, utility bills can consume a significant portion of monthly profits.

The Loss: A single AC left running in an empty room for 10 hours a day can cost you ₹2,000+ per month. Multiply that by 10 rooms, and you’re losing a significant chunk of your profit.

The RentOk Solution: RentOk features a Digital Meter Reading tool. You (or your manager) simply input the sub-meter reading into the app. RentOk calculates the bill based on the slab rate and adds it to the tenant’s monthly invoice.

The Result: Tenants become conscious of their usage, and your electricity bills drop by an average of 20–30%.

To control this, professionally managed PGs are shifting to sub-meter-based billing and usage-based invoicing. With digital meter reading tools, electricity consumption is transparently recorded and billed to tenants based on actual usage. This accountability encourages responsible behavior, and PG owners typically experience a 20–30% reduction in electricity expenses.

4. Vacancy Losses Due to Poor Exit Planning

Every vacant bed represents revenue that can never be recovered. However, many PG owners only begin searching for replacement tenants after a resident has already vacated, creating avoidable downtime.

For instance, if a room with a monthly rent of ₹10,000 remains vacant for five days, the loss amounts to ₹1,666 for that bed alone. Across 50–100 beds, such gaps can result in losses running into lakhs each year.

The Loss: A 5-day gap between tenants in a ₹10,000 room is a loss of ₹1,666. Over 100 beds, these gaps can cost you lakhs per year.

The RentOk Solution: RentOk forces a “Digital Notice Period.” If a tenant wants to leave, they must submit a notice through the app. This instantly alerts your dashboard, allowing you to list that bed as “Available from [Date]” on your marketing channels 30 days in advance.

The Result: “Back-to-back” bookings that keep your occupancy at near 100%.

Digitally managed PGs prevent this by enforcing mandatory notice periods and ensuring advance visibility of upcoming vacancies. When tenants submit exit requests digitally, owners receive early alerts and can start marketing the bed before it becomes vacant. This approach enables back-to-back occupancy and helps maintain consistently high utilization rates.

See how landlords improved their occupancy with RentOk.

5. Staff, Vendor & Maintenance Expense Leakages

For PG owners who are not physically present at the property, monitoring daily expenses can be challenging. Common issues include inflated repair bills, unverified maintenance work, and missing cleaning supplies or inventory. These losses often appear small individually but occur repeatedly, making them difficult to detect and easy to overlook.

- The Loss: Inflated vendor bills, “ghost” repairs, and missing inventory (cleaning supplies, groceries).

- The RentOk Solution: RentOk’s Expense Management & Ticketing System requires every expense to be logged with a digital receipt. Tenants raise maintenance tickets directly; you can see when the ticket was raised, when it was fixed, and exactly how much was paid to the vendor.

- The Result: Total transparency. You see every rupee that leaves your business, preventing “leakage” from staff or vendor overcharging.

Professional PG operators address this by implementing maintenance ticketing and structured expense management systems. Modern PG management platforms require every maintenance request and expense to be logged digitally, along with receipts and vendor details. With solutions like RentOk’s expense management system, each rupee spent is recorded, categorized, and fully traceable, leading to improved accountability, better cost control, and reduced pilferage.

Conclusion

PG management is fundamentally a margin-driven business. Small operational leakages across rent collection, security deposits, utilities, vacancies, and maintenance expenses can collectively reduce 15–20% of total revenue. The most successful PG owners are not necessarily working harder; they are working smarter by adopting PG management software that brings structure, transparency, and automation into daily operations.

Modern platforms such as RentOk go beyond simple record-keeping. They function as profit-protection systems designed to eliminate inefficiencies and safeguard margins in PG businesses.

Frequently Asked Questions (FAQs)

1. Why do PG owners lose money despite high occupancy?

Most PG owners lose money due to operational inefficiencies rather than lack of tenants. Common issues include delayed rent collection, untracked late fees, excessive utility usage, vacancy gaps between tenants, and unmonitored maintenance expenses. These small leakages compound over time and reduce overall profitability.

2. What is the biggest hidden financial leakage in PG operations?

The most common hidden leakage is inconsistent rent collection, including missed late fees and forgotten pending balances. Since these losses are rarely recorded, PG owners often underestimate how much revenue they are losing each month.

3. How can PG owners reduce electricity and water costs?

PG owners can significantly reduce utility costs by shifting from flat-rate billing to usage-based billing. Using sub-meters and digital meter reading systems encourages tenants to be more conscious of consumption, often resulting in a 20–30% reduction in electricity expenses.

4. How does poor tenant exit planning affect PG profitability?

When tenant exits are not planned in advance, beds remain vacant between occupancies. Even a few days of vacancy per bed can result in substantial annual revenue loss across larger PGs. Enforcing digital notice periods helps maintain near-full occupancy.

5. Why are security deposits often not enough to cover damages?

Without proper move-in documentation and structured move-out settlements, PG owners lack proof of tenant-caused damage or pending dues. This leads to unrecovered repair and utility costs. Digital onboarding and Full & Final settlement processes help ensure deposits are adjusted correctly.

6. Is PG management software worth the investment?

Yes. Most PG owners recover the cost of PG management software through improved rent collection, reduced vacancy periods, lower electricity bills, and better expense control. The return on investment is typically realized within the first few months of use.

7. How can PG owners prevent staff and vendor expense leakage?

Expense leakage can be minimized by using maintenance ticketing systems and mandatory digital expense logging with receipts. This creates transparency, accountability, and clear tracking of all vendor payments and repairs.

8. Can small PGs benefit from digital management systems?

Absolutely. Even PGs with 15–20 beds benefit from automation by reducing manual errors, improving payment discipline, and gaining better visibility into expenses and occupancy trends.

9. What should a PG owner look for in a management system?

A good PG management system should offer rent tracking, automated reminders, security deposit management, utility billing, vacancy tracking, maintenance ticketing, and expense reporting—all in one platform.

10. How do professional PG owners maintain consistent cash flow?

Professional PG owners maintain consistent cash flow by automating rent collection, enforcing payment rules uniformly, tracking every expense, and planning tenant exits in advance using digital systems.