If you’ve ever rented a flat in India, whether it’s a cozy place in Bangalore, a room in Mumbai, or a PG in Delhi, you’ve definitely heard the term “security deposit.” It’s one of those things that shows up in nearly every rental deal, but not everyone fully understands what it actually covers or how it’s supposed to work.

This blog will clear this up. We’ll walk through what a security deposit really is, how much landlords typically ask for in India, why it’s taken, how to claim it back, and what could get in the way of getting your money returned. Plus, we’ll take a look at how digital tools are making the whole process way easier and more transparent for both tenants and landlords.

What is a Security Deposit?

In simple terms, a security deposit is a refundable amount that a tenant pays to a landlord before moving into a rental property. It’s kind of like a financial safety net for the landlord just in case something goes wrong. If the rent isn’t paid, the property is damaged, or the agreement is violated, the landlord can use the deposit to cover those costs.

But it’s important to note that this isn’t a fee, and it’s not rent. It’s your money, held temporarily, and assuming all goes well during your stay, it should be returned to you once you move out.

How Much is Typically Taken as a Security Deposit in India?

The amount of the deposit usually depends on a few factors, and it can vary quite a bit based on where you are and what kind of place you’re renting.

By City or Region:

- Bengaluru: It is historically known for asking up to 10 months’ rent as a deposit, though many landlords have reduced this to around 2-3 months in recent years.

- Mumbai: Usually around 3-6 months of rent.

- Delhi NCR: Commonly 2-3 months’ rent.

- Chennai, Pune, Hyderabad: Typically falls between 2 to 6 months.

Other Influencing Factors:

- Furnished homes usually come with a higher deposit.

- PGs or shared flats might only ask for one or two months.

- Sometimes, the landlords also collect extra deposits for things like water connections, maintenance, or even garage access.

To avoid confusion, apps like RentOk can help both parties clearly agree on the exact deposit amount and digitally record the transaction and terms.

Why Do Landlords Take a Security Deposit?

Landlords ask for security deposits as a precaution. Here are a few reasons why it’s considered necessary:

- Unpaid rent: If the tenant skips the last month or defaults.

- Damage to the property: Especially if it goes beyond everyday wear and tear.

- Breach of agreement: Like unauthorized guests or subletting.

- Cleaning expenses: If the house is left in poor condition.

- Missing items: Appliances, keys, or fixtures that are unaccounted for at move-out.

Having a deposit gives landlords some peace of mind. And for tenants, it’s a reminder to take care of the place during the stay. Apps like RentOk make this easier to manage by offering checklists and documentation tools for both sides.

How to Get Your Security Deposit Back in India

Getting your deposit back isn’t difficult as long as you leave the property in good shape and follow the terms of your agreement. Here’s what you can do to ensure a smooth security deposit claim:

- Serve the Right Notice

Give your landlord proper notice, as mentioned in your rental agreement (usually 30 days).

- Clean the Property Well

Before moving out, clean thoroughly, especially the kitchen, bathrooms, and floors.

- Fix Minor Issues

Patch small holes, replace broken light bulbs, and handle any minor fixes you’re responsible for.

- Do a Final Walkthrough

Ask your landlord to inspect the property with you before you leave. RentOk lets you document this with time-stamped photos and notes, which can help if there’s ever a dispute.

- Hand Over All Keys and Bills

Return all keys, remotes, and clear pending utility bills.

After this, your landlord should return your deposit, usually within 7 to 30 days. If there are deductions, they should give you a breakdown of what’s being withheld and why.

Why You Might Not Get Your Full Deposit Back

Not every tenant gets their entire deposit returned, and sometimes, the deductions are justified. Here are some common reasons:

- Pending rent or utility payments

- Visible damage to the property (like broken tiles or stained walls)

- Dirty or unclean home at move-out

- Missing items like remotes, keys, or appliances

- Violating the lease terms

However, landlords can’t deduct money for normal wear and tear. So, things like faded paint or minor wall scuffs don’t count as damages.

Managing Security Deposits the Smart Way with RentOk

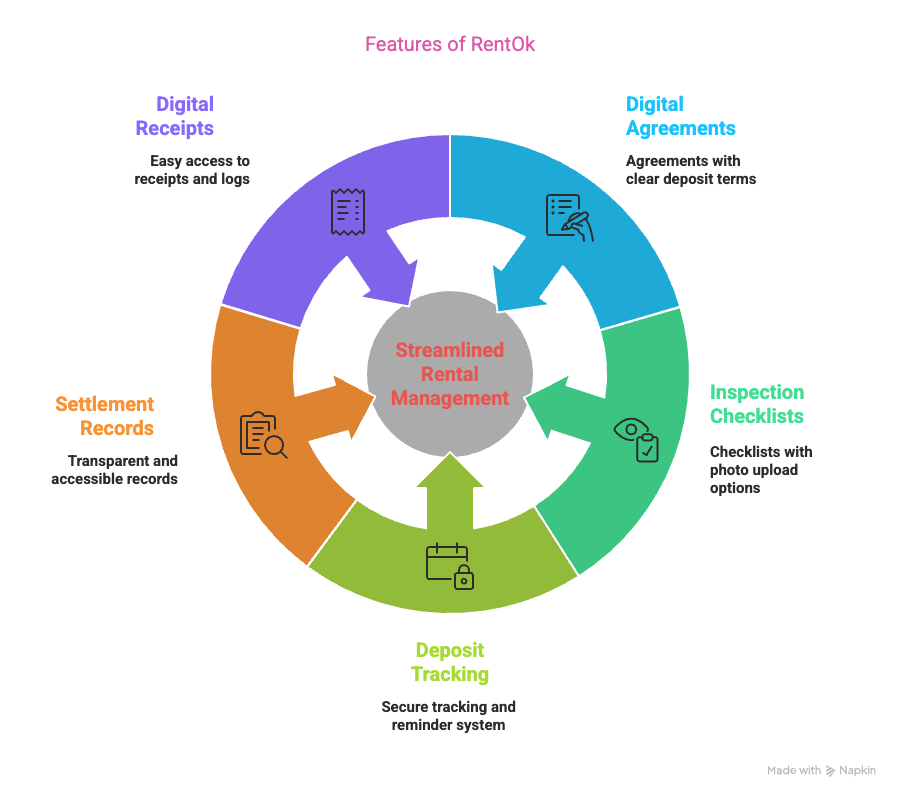

Managing deposits the old-school way with handwritten receipts and verbal agreements can get messy. That’s where RentOk comes in. It’s an easy-to-use app designed for the Indian rental market, helping both landlords and tenants stay on the same page.

Here’s what RentOk offers:

- Digital agreements with clearly stated deposit terms

- Move-in and move-out inspection checklists with photo uploads

- Secure deposit tracking and reminders

- Transparent settlement records

- Easy-to-access digital receipts and deduction logs

With everything documented and accessible on your phone, there’s less confusion, fewer disputes, and a lot more peace of mind. If you feel deductions are unfair, having documentation from RentOk can be a real lifesaver. It creates a clear record of the property’s condition before and after your stay.

Conclusion

Security deposits are a standard part of renting in India, but that doesn’t mean they have to be stressful or confusing. By understanding your rights, maintaining the property, and using tools like RentOk, you can avoid most of the common issues that lead to disputes.

Whether you’re a tenant trying to claim your security deposit in India or a landlord trying to protect your property, clarity and communication are key. And when you have digital support backing you up, managing things like security deposit claims or deduction tracking becomes a whole lot easier.So the next time you’re entering into a rental agreement, make sure your security deposit management is just as sorted as the move-in date.