INTRODUCTION

Are you someone whose livelihood is dependent on your rented property? Are you someone confused about how to save tax on rental income? Do you have the zeal to broaden your knowledge to save your income?

Well then this article is for you!!

When we rent a property, the rental income is subject to taxation. Evaluation of the property’s Gross Annual Value (GAV) is necessary to calculate the income tax on house rent. Also, the rental income received through the property is the base of the property’s GAV.

Section 24 of the Income Tax Act, 1961 states about tax payment. It mentions two headings –

- Income from House Property

- Income from other sources

Read ahead to know more in detail

KEY POINTS FOR CALCULATION OF TAX ON RENTAL INCOME

- Rental income is subject to taxation under Section 24 of the Income Tax Act 1961.

- The taxation of rent from a building or house is under the head, “Income from House Property”.

- Taxation of income from vacant land is under the heading, “Income from Other Sources”.

- If an individual owns more than one property in his or her name then –

a.) To treat any one property as Self Occupied Property (SOP)

b.) To treat the other property as Deemed Let Out Property (DLOP)

c.) DLOP property put at par with a let-out property during taxation.

d.) So, the rental value is the gross taxable rent for such property.

- Taxation of a property is at its gross annual value (GAV)

- Estimation of GAV :

subtracting municipal taxes, standard deduction and interest paid towards home loans.

- Landlords can claim a 30% standard deduction of annual value to cover repair expenses

- The act :

A) exempts a person from paying tax on rental income if GAV of a property is below Rs 2.5 lakh.

B) Hold any property rented for business purposes to pay 18% tax as per the GST Act.

C) Exempts any property rented for residential purposes to pay tax under the GST Act.

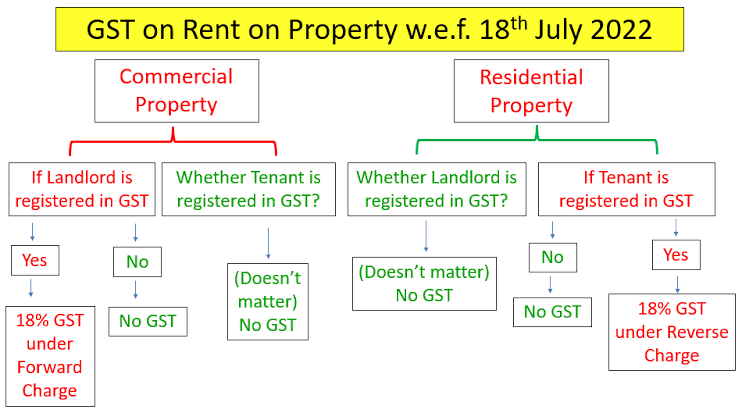

GST ON RENTAL INCOME

Renting a property is now considered a taxable supply of service under the GST regime. The applicability of GST on rental income depends on various factors such as:

1. the location of the property

2. the type of property, and

3. the purpose for renting.

Also, GST on rental income is applicable when a landlord receives an annual rent of Rs 20 lakh. It exempts Landlords having an annual turnover of less than Rs. 20 lakhs.

GST on Rent is different from GST on Rental Income to know more about it click here

WHEN IS A PROPERTY LIABLE TO ATTRACT TAX

- Letting out a property out on lease, rent, or easement

- Leasing any commercial, industrial, or residential property out for business.

- 18% GST, If a person rents out any other type of immovable property for business purposes.

**Exemption of renting out a residential property for residential purposes from GST

**To calculate the GST on rented-out properties, use the following formula

GST = Rent x (18/100)

CLAIMING OF ITC

ITC stands for Input Tax Credit.

- Law entitles rentpayers registered under GST to claim an Input Tax Credit.

- The person can claim ITC on the GST paid on the rent amount

Conditions for claiming ITC

- Usage of rented property for business purpose.

- The landlord deposited the GST charged on the rent to the government.

The image below tells more about GST on rental income:

HOW TO SAVE TAX ON RENTAL INCOME

Let’s dive in further to know the ways through which one can save tax on rental income :

- STANDARD DEDUCTION

Section 24 provides a 30% tax deduction on the net annual value of the property. This is for maintenance and repairs. This amount does not include municipal taxes. It allows a 30% house rent deduction in the income tax section. This is regardless of whether the expenses of repairs are lower or higher than the 30% deduction. - JOINT PROPERTY

Purchasing a joint property is another way to save tax on rental income. Splitting rental income into two helps to save tax. The government charges tax in proportion to all the joint owners. - MUNICIPAL TAXES

Local authorities have the power to levy this tax. It includes sewage & property taxes and is subject to subtraction from rental income tax. The owner can deduct municipal taxes. If they paid it during the concerned financial year. Thus, landlords must ensure to pay municipal taxes on time each year. Furthermore, landlords and not renters should pay the municipal tax. - MAINTENANCE CHARGES

The landlord can ask renters to pay maintenance charges directly to the society. This will lower the rent amount. Hence, would help him to save tax on rental income. Also, landlords can divide rent into two categories – house rent and maintenance charge. This will split the lump sum payment into small payment amounts. Hence, helping the landlord to save tax on rental income.

Pro tip: Use RentOk app wallet to do this easily

Click here to download: Download RentOk app - COST OF FURNISHING

The landlord can ask the tenants to pay the cost of amenities or service charges to the concerned authorities or in a different account. Amenities include electricity, wifi etc . This will lower the rent amount. Hence, it will aid in saving tax on rental income.

CONCLUSION

To sum up, all landlords must be aware of the Rental Income Tax Laws in India. It not only helps to save tax on the rental income but also helps to fulfil statutory norms. On-time payment of tax offers a wide range of home loans and co-ownership benefits for landlords. Hence, it is a beneficiary for the landlords in India.

Read more blogs of RentOk

Best PG manager app, Best rent collection app in India, Rent agreement format, Top 5 PG in Gurgaon, free rent agreement, online police verification, Complete Rent Agreement Format for 2023, tenant management software, Best PG manager app, Top 5 property management app, Haryana rent control act, Delhi rent control act